Disruption in the financial sector due to new technologies

We highlight blockchain and artificial intelligence as two technologies that will introduce drastic changes in different sectors, including the financial one.

Blockchain

It consists of a set of technologies that enable the decentralization of information and transactions, ensuring traceability and security by eliminating the need of a control agent in charge of verifying the consistency and legality of the transaction.

An example would be cryptocurrencies: virtual currencies not regulated by a financial authority, such as Bitcoin or Ether.

Blockchain has great potential for development through smart contracts, which are self-executed by both parties (buyer and seller) anonymous and with no need for a prior contract. Smart contracts are written in code and verified by an anonymous network of nodes that guarantees its execution in a secure, decentralized, and irreversible way, without the need for a central authority or legal system to certify it.

This type of contract will have great impact on the financial world by generating a new business model with different agents. It reduces operating costs via reduction of paperwork and the elimination of the regulator figure, which increases the demand for this type of contract due to its simplicity and reliability.

Artificial Intelligence

Artificial intelligence uses algorithms capable of mimicking unique human abilities such as learning or problem solving.

AI is in development phase and will be key in the creation of new customer relationship models by modifying the usual customer contact channels and generating new ways of interacting with them.

Lately we have seen a decrease in personalized customer service in branches and an increase of online banking, for contact as well as daily operations. Banks are already using AI in their customer service introducing Chatbots and risk detection models to assess a customer’s level of non-payment.

The trend points to a progressive increase of AI in its portfolio of services: virtual assistants instead of personal assistants, facial recognition, augmented reality, bio-scanner…

Another AI use for the financial sector is the automation of the operational processes of financial agents such as trading and investment, risk analysis, fraud detection or compliance.

The financial sector is undoubtedly being affected by new technologies, just like other sectors. It is discovering new opportunities and facing great challenges that allow it to change and adapt its services to the new reality by implementing blockchain and artificial intelligence.

See more articles related to Blog

Created on: 06/03/2026

Navigating the Interview Trap: MIU Faculty Research Explores the Science of Hiring

At MIU City University Miami, our faculty members are active researchers working to shape the evolution of their fields. We […]

Blog

Created on: 25/02/2025

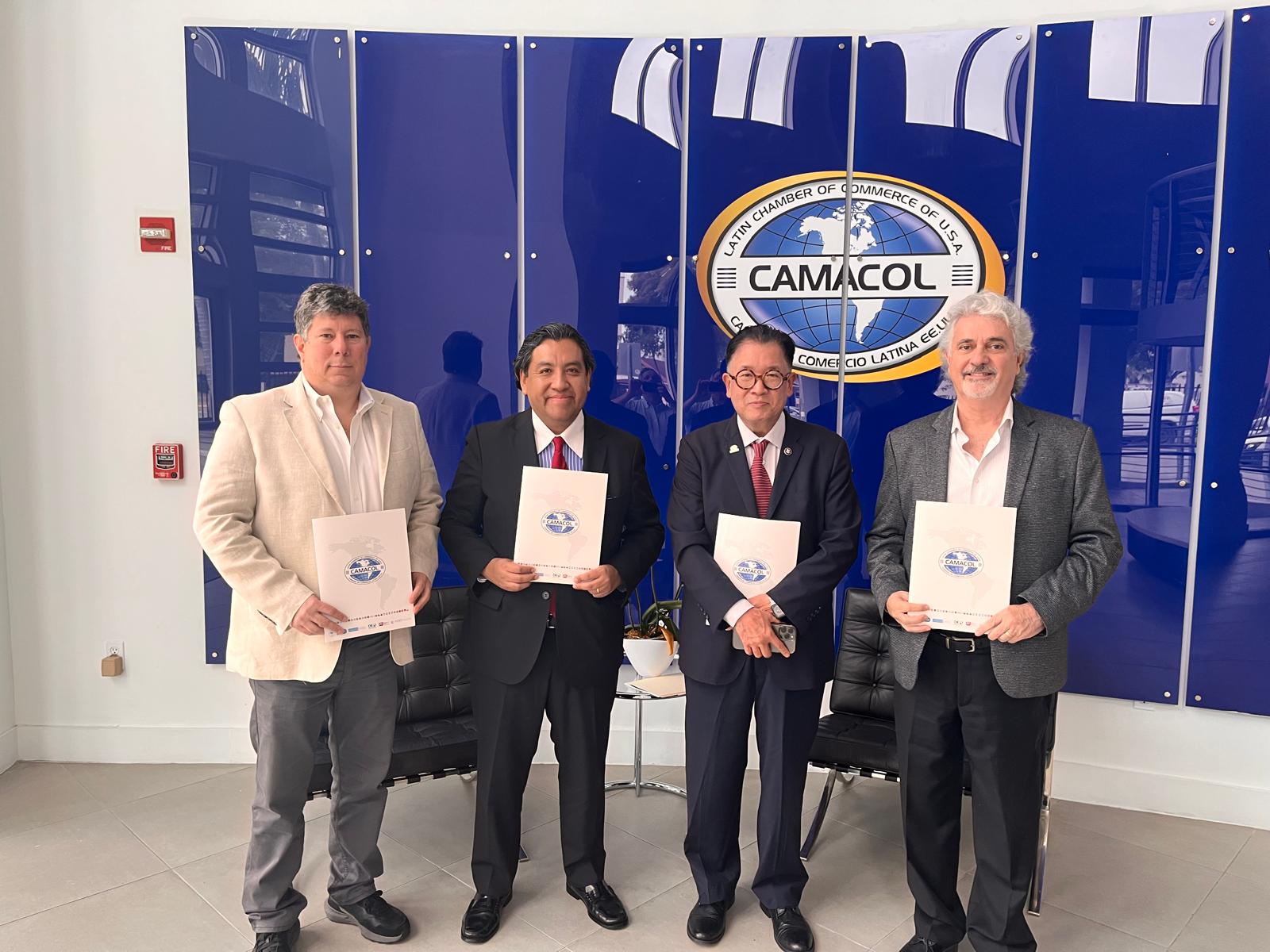

MIU City University Miami and CAMACOL Sign an Agreement to Promote Education and Business Development

Miami, January 16, 2025 MIU City University Miami and The Latin Chamber of Commerce of the United States (CAMACOL) have […]

Blog

Created on: 18/03/2025

UNIR Innovation Day Miami: Chema Alonso and Iker Casillas Lead the Charge for Cibersecurity and AI Education

Chema Alonso and Iker Casillas advocate for quality education to tackle the challenges of Cybersecurity and AI at UNIR Innovation […]

Blog